THE GREEN LINE GUIDE TO...

setting up your business in toronto

Bilqees Grant, co-founder of Helius Originals, shows her company's food and drink smoking kit.

The Green Line

The Green Line is an award-winning, hyperlocal publication that delivers information you can actually use in your daily life.

Nov. 17, 2025

This guide is part of our November Action Journey on inclusive entrepreneurship and innovation in Toronto, which was developed in partnership with Untitled Planning. The Green Line maintains full editorial independence to ensure journalistic integrity.

Do you have a compelling business idea but don’t know where to start?

We asked Olu Villasa, program manager at the Black Entrepreneurship Alliance, for his expert advice on how to turn that dream into a business.

- Start by checking out Small Business Services, which are part of the Federal Economic Development Agency for Southern Ontario. These services will help you understand the different types of businesses, taxes and how to hire employees.

- Visit your local Small Business Enterprise Centre for free consultations with a qualified business consultant and a review of your business plan. You can also attend workshops and seminars.

- If you're a Black-identifying aspiring entrepreneur looking to validate, plan and develop your ideas into scalable and profitable ventures, apply for a free one-on-one consultation with a BEA team lead. They’ll evaluate your career roadmap and get you connected to opportunities within your industry and market.

- Once you have a business plan, you can start applying for grants.

Funding opportunities

There are many funding opportunities from all levels of governments in Canada. Here are some to check out to get you started:

- federal grants via Business Benefits Finder;

- provincial grants, including Racialized and Indigenous Supports for Entrepreneurs (RAISE);

- City of Toronto business grants, including the Summer Company Grant, which provides micro funding to eligible young student entrepreneurs, aged 15 to 29, looking to launch and operate a small business during the summer;

- the DMZ Black Innovation Program;

- the i.d.e.a. Fund for entrepreneurs who have early-stage businesses or small to medium enterprises headquartered in Southern Ontario;

- Lenovo's Evolve Small grant, which supports minority, disabled and woman-owned small businesses.

Looking to hear from someone who’s already been through it? No worries, we already asked.

Kwasi Adu-Poku, founder of The Reach Series, a speaking and apparel social enterprise, credits the $10,000 RAISE grant from the Ontario government with providing the capital to scale up his business digitally. It helped him redesign his website and get a social media consultant.

Bilqees Grant, co-founder of Helius Originals, which produces food and drink smokers and smoking accessories, has received a number of grants over the past four years, including $30,000 from the i.d.e.a. Fund and $25,000 from the Nventure — both of which receive federal government funding. She’s also received $25,000 USD from the Lenovo’s Evolve Small grant, which supports minority, disabled and woman-owned small businesses and is funded by businesses and non-profits.

Even with these grants, Bilqees Grant says she and her fellow co-founder have personally invested more than six figures into developing products, which are currently in the process of being patented.

Top tips from entrepreneurs

“Sometimes you just have to jump in,” Bilqees Grant says. “You're never going to have the perfect time to launch. You're not going to ever know [everything]. It's trials and tribulations…so I would say just start and try your best and lean on your network.”

Courtney Grant, who owns five Jamaican restaurants in Toronto, says new entrepreneurs should prepare well ahead of launching. “Research what you're going to be doing. Look at your competitors, look at the market, look at the demand.”

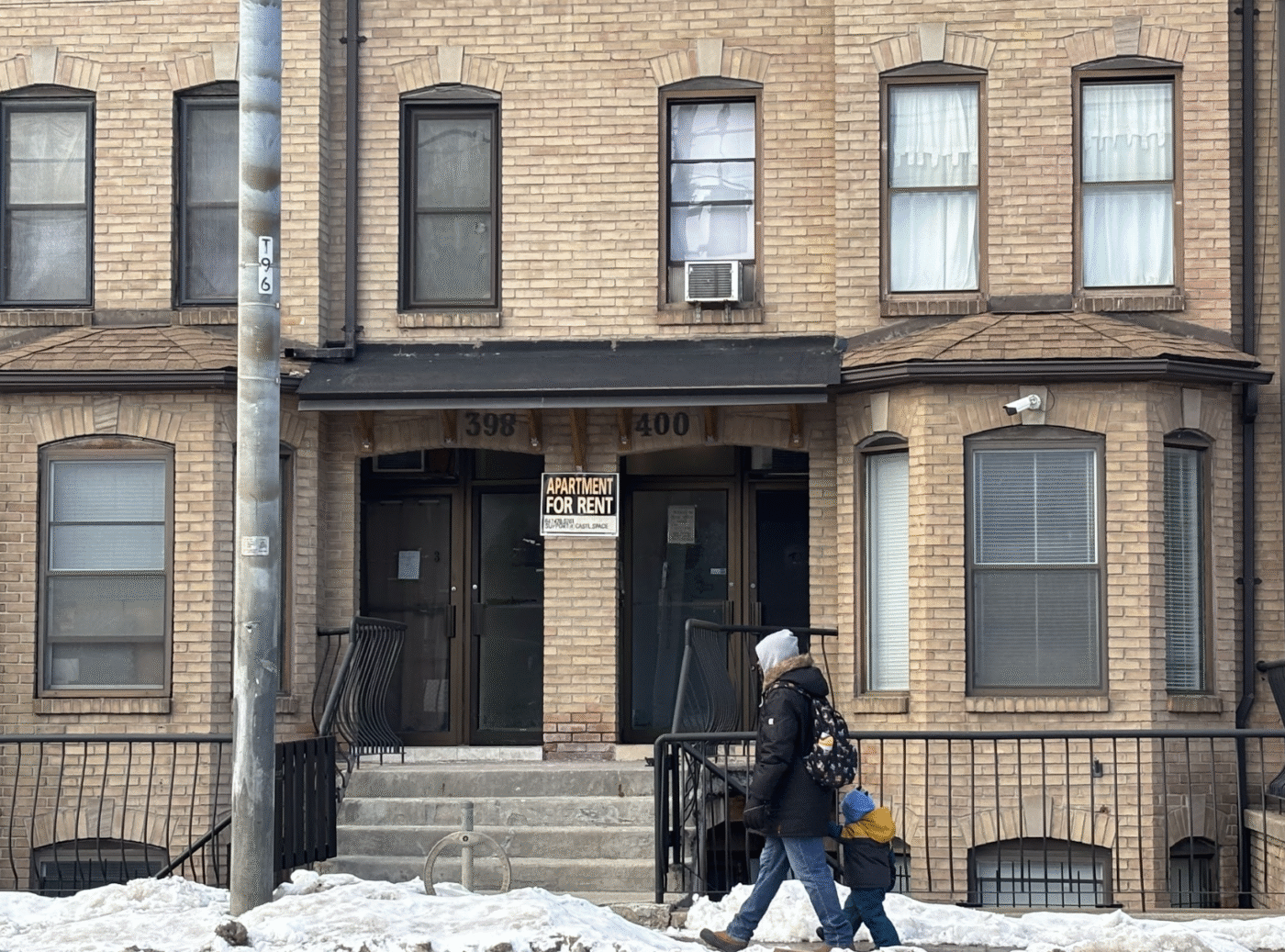

He adds, “if you need a physical storefront, try to get a solid lease. You might not be able to own the property…but make sure you get a 10 to 15-year lease,” so that the landlord can’t hike rent above an agreed amount or sell the property without compensating you.

Courtney Grant, owner of Caribbean Queen Jerk and his staff at one of the restaurant's five locations

Kwasi Adu-Poku recommends new entrepreneurs identify and honour their story.

“Once you connect things to your story, your positionality, your area of credibility and expertise…I think that's when the magic happens,” he adds.

Bilqees Grant agrees, explaining that at first, she was very nervous about being a Black woman in a luxury space because she wasn't sure how customers would respond. But then she leaned into her identity and decided “if those people don't want to buy from you, then they're not your customers to begin with.”

She says instead of catering for a specific demographic, “you can just provide a good service or product, and whoever likes it, likes it.”

Adu-Poku advises, “don't chase the grants. It's really about the customer base. Speak to your customer. Don’t chase [venture capital] dollars. Don’t chase loans.”

Fact-Check Yourself

Sources and

further reading

Don't take our word for it —

check our sources for yourself.